Digital Transformation | 17 Nov 2023 | 13 min

How to overcome the ‘C’(sea) of challenges in BFSI?

As of 2023, the fintech industry is worth a whopping $179 billion. Yes, you read it right!

Over the past few years, the banking sector has undergone significant changes, mainly due to the rise of the BFSI (Banking, Financial Services, and Insurance) sector. This shift has not only changed how traditional banking works but also created numerous opportunities for businesses.

The BFSI sector covers a wide range of – financial products, services, and risk management expertise, making it a hub for financial innovation.

Great news!

My blog will provide an in-depth exploration of the banking and financial sector, encompassing areas such as:

With this blog, you will gain the knowledge needed to make informed decisions that can propel your business beyond conventional benchmarks.

Let’s begin!

Amid the global pandemic’s challenges, the banking and fintech sectors are undergoing a profound transformation as they adjust to the ‘new normal.’

The rapid adoption of digital channels has compelled businesses to navigate a dynamic landscape, meeting evolving consumer demands.

The accelerated digitization of financial services is reshaping how we manage, invest, and transact money. The shift to digital banking and fintech was already underway, but the pandemic’s urgency has expedited it, leading to an unprecedented surge in:

Here are 3 remarkable statistics for you to get a glimpse of the growth of the BFSI arena at present:

Interesting, right?

Next up, I will be throwing light on how the BFSI is set out to transform the digital terrain.

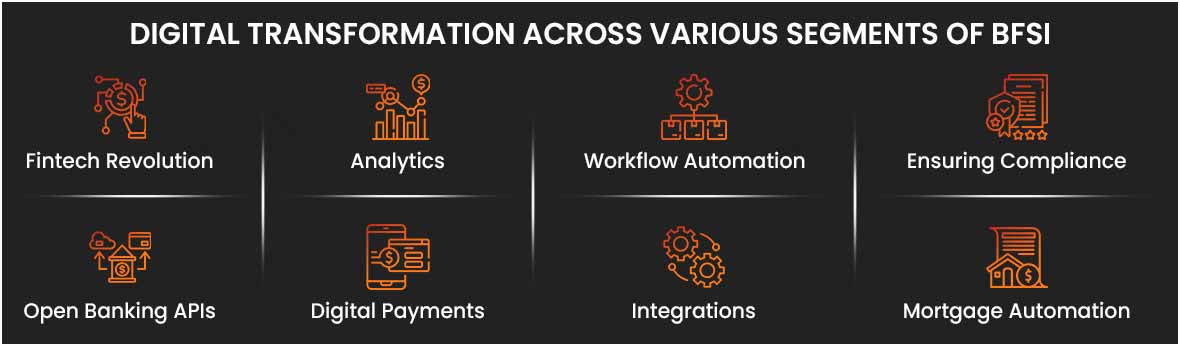

Here are the key areas where the BFSI sector has been making significant advancements:

Automating the workflow accelerates time-to-market for new products and services. Thus, ensuring that the BFSI sector remains agile and competitive in a rapidly evolving digital landscape.

Note: Navigating the complex world of such BFSI segments requires understanding both the challenges and the ways to overcome them.

Onwards to it!

Here are the waves of challenges faced by organizations serving the BFSI ocean, along with effective strategies to address each one:

Challenge: Safeguarding confidential financial data is paramount, especially in the face of increasing cyber threats. Without a robust security strategy, businesses are always at risk of data breaches and financial losses.

Solution: To solve this problem, businesses should spend on:

Challenge: The ever-changing landscape of financial regulations poses a significant challenge, as non-compliance can lead to legal complications and fines.

Solution: To overcome regulatory hurdles, businesses must – employ compliance management systems and stay updated with the latest changes in financial laws. Thus, ensuring they align their practices accordingly.

Challenge: Funding digital transformation initiatives can be financially daunting, but in an increasingly digital world, these investments are necessary for survival and growth.

Solution: To address this challenge, companies should prioritize digital investments strategically, focusing on areas with the most significant potential returns. Further, embracing cloud-based solutions can also reduce costs while enhancing scalability and efficiency.

Challenge: Establishing and preserving customer trust is vital in a time when data breaches are prevalent. Failing to maintain trust can result in a loss of business and reputation.

Solution: To address this challenge, businesses should maintain transparent communication regarding security measures and data protection policies. Establishing a track record of data security and privacy is crucial in building and preserving customer trust.

Challenge: Traditional financial institutions face stiff competition from nimble fintech startups, making it essential to adapt and innovate to stay relevant.

Solution: To stay competitive, businesses can opt for collaboration with fintech firms, which often leads to mutually beneficial partnerships. Alternatively, organizations can innovate by offering unique services, improving customer experiences, and embracing the agility and technological advancements that fintech startups bring to the industry.

So, the landscape is evolving rapidly, with opportunities for innovative ISVs and fintech companies to create valuable solutions that meet the changing needs of consumers. As the financial world continues to embrace digital transformation, the possibilities for innovation and growth are limitless.

In the next five years, we can expect a period of consolidation where incumbent firms will embrace digital transformation to deepen their capabilities.

Simultaneously, mature fintech companies will explore partnerships to drive disruption and customer-focused innovation.

To tackle shifting threats and build operational resilience we, Nitor Infotech, might just be your right companion in the global BFSI space.

Reach out to us for your next big step!

we'll keep you in the loop with everything that's trending in the tech world.